There are a few different ways banks in Africa could use an SMS API. For example, a bank could use an SMS API to send out alerts to their customers about changes in their account balances or about fraudulent activity. A bank could also use an SMS API to send out marketing messages or to provide customer support.

The benefits of using an SMS API for banks are numerous. First, it would allow the bank to reach a larger audience with their messages. Second, it would allow the bank to send messages in real-time, which is important for time-sensitive information. Third, an SMS API would allow the bank to track the delivery and read rates of their messages, so they could gauge the effectiveness of their communications.

Many customers in AFRICA use SMS to receive alerts and notifications from their financial institutions. In fact, as of 2020, more than 1.7 billion people were using SMS services and messaging apps on a monthly basis according to Forrester Research.

SMS API integration is relatively simple and can be accomplished with any number of SMS API providers. The most important thing is to choose a provider that offers a reliable, robust API that can handle the high volume of messages that a bank will likely need to send.

Once the SMS API is integrated, banks can start using SMS to improve customer engagement and loyalty. With the right messages, banks in Africa can keep their customers informed and up-to-date on their account status, and promote special offers and discounts that will keep them coming back.

Banks are using SMS API to provide a better customer experience in a number of ways. Here are some examples. SMS API can be used to send :

- balance updates to customers

- fraud alerts to customers

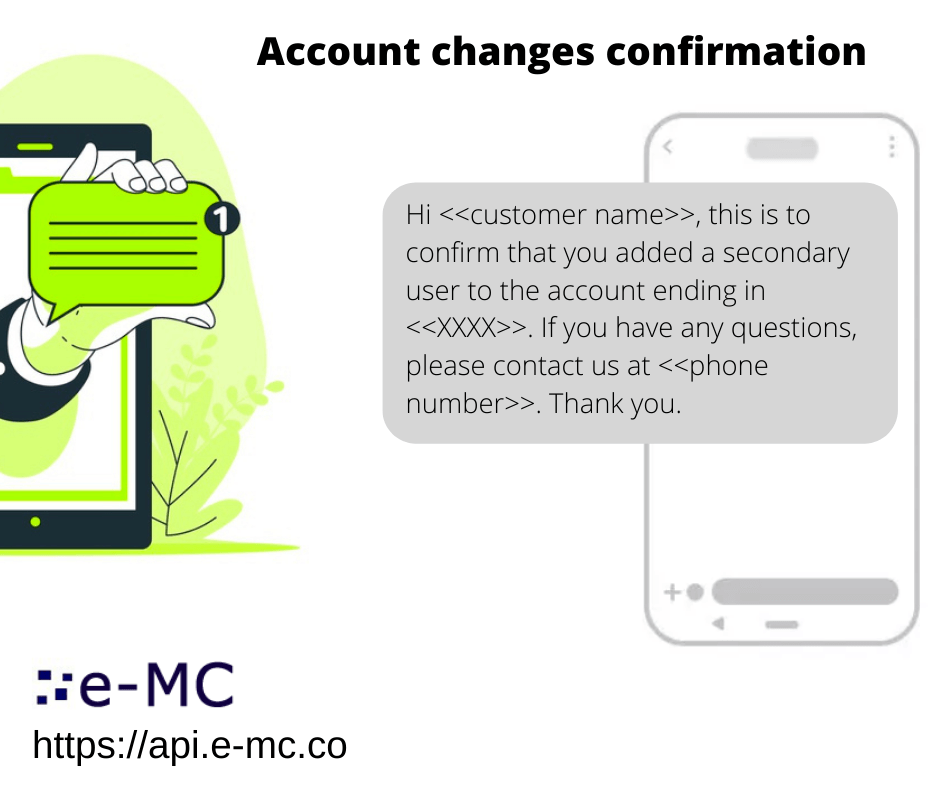

- account notifications to customers

- appointment reminders to customers. This can help reduce no-shows and increase sales.

- transaction alerts to customers.

- promotional messages to customers.This can help increase brand awareness and encourage customers to use the bank’s products and services.

- customer satisfaction surveys to customers.

How SMS API can prevent fraud for BANKS

According to a report by the Wall Street Journal, banks are losing billions of dollars each year to fraud. In fact, fraud is the second most common type of crime in the U.S., and it’s only getting worse.

One of the biggest problems for banks is that they are constantly under attack by sophisticated criminals who are always finding new ways to commit fraud. This makes it difficult for banks to keep up with the latest trends and prevent fraud.

One way that banks can fight back against fraudsters is by using SMS API. SMS API can help banks prevent fraud in a number of ways.

First, SMS API can be used to verify the identity of a customer. When a customer initiates a transaction, the bank can send a text message to the customer’s mobile phone. The customer then enters a code that is sent to the bank. This helps to ensure that the person initiating the transaction is who they say they are.

Second, SMS API can be used to send alerts to customers. If a bank suspects that a customer’s account has been compromised, it can send an alert to the customer’s mobile phone. This gives the customer the opportunity to take action to prevent further fraud.

Third, SMS API can be used to track transactions. When a transaction is made, the bank can send a text message to the customer’s mobile phone. This allows the bank to keep track of the transaction and see if there are any suspicious activities.

Fourth, SMS API can be used to block transactions. If a bank suspects that a transaction is fraudulent, it can block the transaction. This prevents the fraudster from getting the money that they are trying to steal.

SMS API is a powerful tool that can help banks prevent fraud. By using SMS API, banks can verify the identity of customers, send alerts, track transactions, block transactions, and investigate fraud.

Integration of SMS API in bank system. The banking system has undergone a lot of changes in the past few years. With the advent of new technologies, the way banks operate has changed considerably. One such change is the integration of SMS API in the banking system.

The integration of SMS API in the banking system is a win-win situation for both banks and customers. Banks can use this technology to improve their communication with customers and increase their customer base. Customers, on the other hand, can benefit from getting updates about their account balance and transactions directly on their mobile phones.

By harnessing the power of SMS API, banks in Africa can increase sales and improve customer communication. This can help to drive growth and maintain a competitive edge in the market.